Tourism is a business, a very big business. It is especially the case in the Caribbean. This business has many branches and faces and reaches into every corner of the region. Every island is dependant on tourism for a big portion of its economy providing jobs and demand for other products and services throughout these economies.

But, in many destinations, Caribbean tourism is not being conducted like a business. Instead, the tourism agencies, although usually separate from government, are being handled like a government department with the corresponding bureaucracy and political meddling. This bureaucracy and management style results in a tourism business that is short on expertise and responsiveness to the changing 'World Class' style of tourism. It reveals an endemic lack of engagement with the local tourism business entities and leading business people.

Many managers are hired and fired with short term tenures and politically based management styles that result in instability and a lack of overall focus in the direction that tourism needs in order to move forward.

Because they are political appointees, chosen from recently elected representatives, they often have limited knowledge of tourism and related issues. They come into their positions with a high level of authority to make changes in personnel and operational structures —and they do. They often replace existing personnel on the basis of party affiliation. They often change operations and policies without any consistency with known or accepted standards. They may change branding campaigns without considering how much money has been spent or whether the campaign has run its life. The next election may sweep these people from power and the process starts over. While they are trying hard, this broken style of tourism development is not likely to meet the needs of this competitive industry.

As well, while there are tourism development companies in many islands, they don't have operating structures that are separate from government. Regardless of how they were created, most tourism authorities are reliant on the budgetary allocations sent to them by governments. Whether a government deems tourism to be an important economic sector often decides how much this funding will be.

Caribbean governments need to manage their tourism businesses in a PPP context. These governments need to create management entities that are separate from political interference. They need to create a style of tourism management that enters into partnerships with the private sector to develop the business of Caribbean tourism.

These corporations need to develop their own business plans which include a profit and loss statement, marketing plans, advertising budgets, staffing and so on. While they will never be completely free from political manipulation, they will be mostly able to operate in the style of a business.

The corporations will survey the tourism products available and develop plans around how to promote and manage these assets. They will operate in partnership with local businesses to promote and develop the tourism product. Let the tourism professionals do their very important work. Monitoring checks and balances create an environment that adapts to changing market conditions, based on evidence and strong knowledge.

The successful destinations have a track record of effective management that is mostly free from political interference. These entities have progressed to a business style of management that includes engaging experience tourism professionals, community organizations and other tourism interested parties. They are allocated sufficient financial resources to effectively develop land-based assets as well as to advertise and promote their products in feeder markets. Instead of meddling, the political appointees actively engage with these agencies and support their activities.

The result of a PPP management style is likely to deliver a better quality overall tourism product. By bringing in private sector people into the highest level of decision making improves responsiveness to marketing imperatives and changing conditions on the ground. 'World Class' is not easily attained.

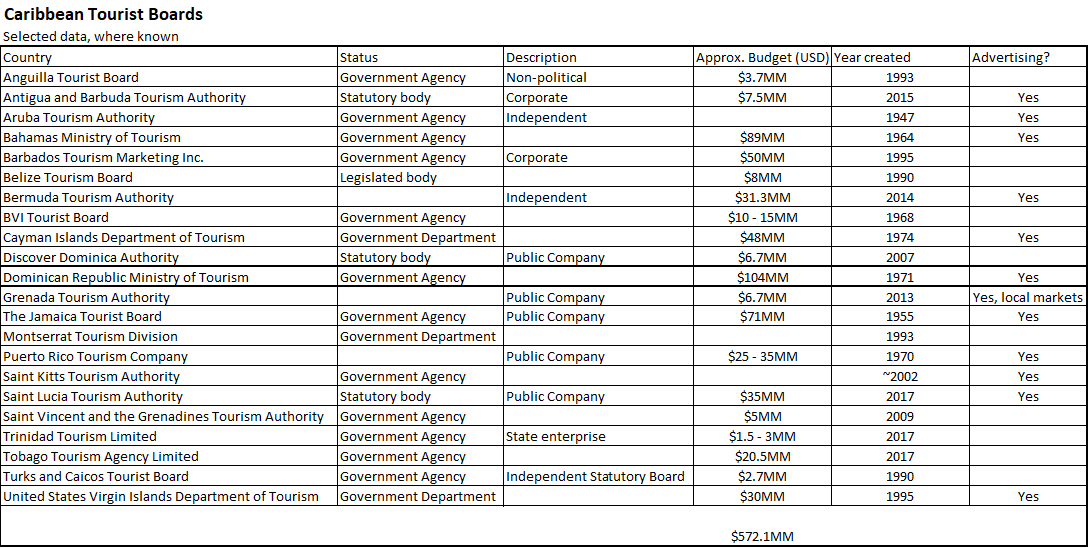

Table 1: Caribbean Tourist Boards, selected data

The total of $572.1MM (approx) is about 1.4% of total visitor spend ($39B). A large portion of this money is spent on local resources and infrastructure.

In tandem, there also needs to be a clear development strategy on transportation both by air and by sea. No tourism is possible without a network of effective and reliable tourism links. This needs to be a regional transport system.

On island, or destination, tourism also needs to be treated with differently and separately from cruise tourism that is, in fact, a competitive product.

But it still won't fix infrastructural issues that are endemic in Caribbean islands. What it will do, however, is allow governments to focus more closely on what needs to be done.

The role of advertising and promotion

Lastly, and most importantly, tourism promotion needs to be allocated sufficient financial resources to effectively promote Caribbean destinations in the face of international competition. Most businesses understand that promotion and advertising are needed to increase awareness amongst the buying public. In many companies where competition is the highest, such as the automobile industry, this cost can be very high, as much as $500 to $1000 per vehicle. In addition, many car companies offer incentives such as rebates and loyalty benefits. That may represent 3%, or more, of the final price. Clearly, advertising is a key tool to increase public awareness of your product and company. Many buyers are looking for advertisers that align with their self-perception or lifestyle choices.

"In Caribbean region, the travel and tourism sector contributed more than 39 billion U.S. dollars to the gross domestic product in 2021. Among all listed Caribbean territories, the Dominican Republic and Cuba registered the highest total contributions of this sector to the GDP". (1)

It follows that advertising and promotion expenditures by Caribbean tourism authorities should be much higher. Unfortunately, most countries don't release advertising expenditure data. Even if Caribbean destinations were to spend 1% of visitor expenditures on advertising, this would represent $390MM. The bulk of tourist board budgets is for spending on local assets so they aren't anywhere close to this number. The largest proportion of tourism expenditures in the Caribbean are for developing infrastructure and also the local tourism product. These are important as they form key aspects of a destination's 'Unique Selling Proposition' (USP) and are also primary delivery mechanisms for another key metric, visitor satisfaction.

As a single example, Jamaica's annual media advertising expenditure for the period from 2019 to 2024 is projected at around $5B JD (about $32M USD). (2) Jamaica's visitor expenditures are around $2.7B USD in 2021, so this advertising budget represents about 1.1% of visitor expenditures. (Total contribution of travel and tourism to the gross domestic product in the Caribbean in 2021, by country or territory) (3) This represents a significant investment by Jamaica in its tourism product and the success of their industry flows from this solid committment to promoting it.

But most Caribbean countries spend far less than this on media advertising.

By contrast, in 2016, "Sandals Resorts International (SRI) spent $50M USD [ ... on its ... ] 'No Worry' worldwide advertising campaign showcasing Jamaica". (4) That's one company and one campaign. Sandals revenue is estimated at $2B USD. (5) Sandals advertising is regularly seen on televisions in major consumer markets. With marketing heft like that, it is no wonder countries are eager to attract Sandals.

Compare this to Thailand, with about $57B USD visitor expenditures, is known to spend more than $140MM USD in tourism promotion, both in media as well as subsidies to tourism accommodations. The actual amount may be closer to $200MM USD. Most of Thailand's visitors are from China and India and this expenditure is meant to boost tourism generally as well as improving the overall tourism product. Despite this, the Tourism Authority of Thailand, 'TAT' calls for more tourism stimulus. Thailand, with a population of 70 million is also coping with fewer visitors and does not want a reputation as a cheap destination. Potential visitors consider value for dollar to be high in their decision making criteria.

"Easing of travel will be the key to boost the international market, and we will have to pivot from a product-centric to a customer-centric approach, attracting more quality demand and urging multi-stakeholders to collaborate in building that new tourism ecosystem," Mr Yuthasak said". (6)

Again, this is a single country but there are many others vying to attract the sun-sea-sand visitor, such as Bali, Fiji, Hawai'i, the Mediterranean, The Seychelles, most of Central America and many others. The Caribbean has a well known reputation for this style of tourism and close proximity to feeder markets is also a big boost. The region, therefore, has a slight advantage but this cannot be taken for granted in a fiercly competitive world.

Setting up the Unique Selling Proposition (USP)

All tourist boards:

- have websites detailing information about travel to their destinations including news and special offers

- have social media pages such as Instagram, facebook, twitter promoting their destination

- are actively involved in developing and improving in destination tourism assets

Most tourist boards:

- subsidize international air carriers to bring visitors to their destination

- participate in annual travel markets and trade shows

- have marketing representatives to directly communicate to travel industry publications, professionals and travel agents

- engage public relations firms to issue press releases about their destinations on a regular basis

Some tourist boards

- have funding for international advertising and promotion

- offer incentives to travel companies and agents to favour promotion and directly selling their destination

So, you have a Unique Selling Proposition (USP) - The case for advertising and promotion

The path to attracting visitors is a complex process and is different for each destination. However, there are two main themes: Setting up the Unique Selling Proposition (USP) and then convincing potential visitors to prefer your USP. In turn, this can be done in a couple of ways. The first is outlined above, wherein tourist boards have a set of tools available to set up and make travel prospects aware of their USP. But, this is only part of the journey.

What is missing is the way to increase the potential visitor's awareness of your destination and your USP. As it is clear that every destination is going to use the tools available to propose a USP that will be used by the traveller as the basis for a comparison of places to visit. This set of values must fit the viewer's mindset of features and qualities that they are seeking out. This includes all aspects of travel; accessibility to places to stay to things to do, and so on.

Unfortunately, the selling process is still not complete. The 'Unique Selling Proposition' needs a boost. Many potential visitors don't start out with a specific destination in mind. If that were so, then no marketing is needed to attract them. They already know where they are going. The only decisions that remain are when and a few more details of what they will do while they are there.

So, what about these potential visitors that don't have a specific destination in mind. Here's where it gets sticky because people in this group start a travel search with very general criteria which probably don't include destinations by name. They have not 'pre-selected' any destination to travel to and don't know anything about the product. So, how does the travel marketer 'jump the queue' so as to improve the chances that the potential visitor —almost always a first time visitor, will choose their destination.

Assuming that the first step in the travel decision making process, the USP, is complete and effective —the only way to hit these visitors in the pocketbook is to promote the destination through advertising.

This also takes two paths: Offline marketing and online marketing. Since nearly every potential visitor will search online for travel information, the use of online advertising is a no brainer. But there are plenty of potential visitors that can be swayed or guided even before the online search begins and that is the function of offline marketing. Both are effective at building awareness of a specific place to travel to. Probably online works out to be quite a lot less costly for most destinations and this is a clear path to building awareness.

Building awareness of a product is a key component in any selling process. It doesn't matter if you're selling toothpaste or an automobile, building brand awareness is key. So, when the potential buyer visits the store and sees the products on the shelf, there must be a trigger that pushes the buyer to choose your product.

The World Wide Web (WWW) can be compared to this store with the search results analagous to the store shelf. In any travel search, the potential buyer has ventured into the store to view the store shelf. So, what aspect of your product will attract the buyer? It is not simply the USP but also the buyer's awareness that will direct them to choose your product, or at least to put it on their short list, and that is the entire purpose of marketing. Many buyers are looking for that trigger, the one that makes them say, 'Yes, that's where I want to go'.

It is tempting to ask why many Caribbean destinations, such as The Bahamas, Jamaica, the Dominican Republic, Puerto Rico, Saint Lucia or the US Virgin Islands spend, or have spent, a huge amount of money in advertising and promotion and this is why. These destination know they are in a competitive market. Building as well as maintaining buyer awareness are important strategies at increasing the competitive advantage. In fact, the bulk of visitors travelling to the Caribbean visit these places, so the buyers decision is often made without even considering any other destination than these ones and they are left to compete for the crumbs that fall off this table.

Worldwide — "A new study found that travel companies spent $2.31 billion on digital, print and television advertising through October 2021". (7)

That's an awful lot of money to be spent on promotion when they have no way to know which destination travellers are going to choose. Oddly, the destination is secondary to many marketers, as long as they have the traveller in their grasp. Take the example of a travel company that offers sun destinations all over the world. This style of marketing opens the possibility that 'co-marketing' may be the way to go for many Caribbean destinations, if not simply to bring down the cost of marketing through co-op advertising, for example.

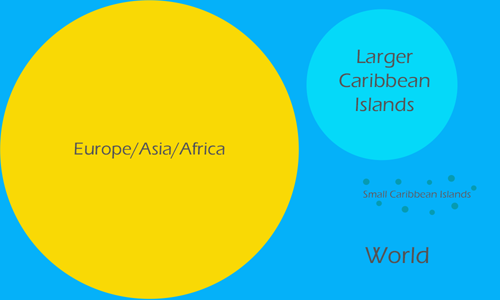

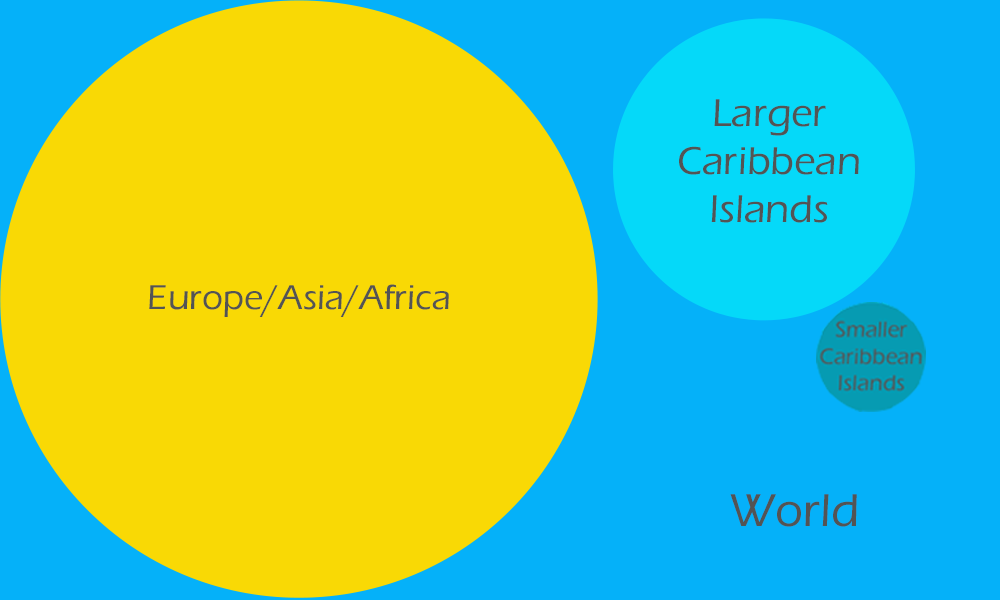

Visual representation of relative impact of advertising. What the potential visitor sees. | |

Image 1: Relative impact of advertising before co-marketing |

Image 2: Relative impact of advertising after co-marketing |

| In image 2, depending on the budget, the impact of co-marketing shows the potential to increase the relative visibility of the smaller Caribbean island destinations. It is likely still less than major markets but is considerably better than any individual marketing might attain. | |

In any case, in order to win the battle of buyer awareness, the destination marketer needs to be on the battlefield. Advertising is an important strategic weapon in this battle. This style of aggressive marketing is what will win this battle for many destinations. When the potential buyer visits the store and sees the product on the shelf, the ones that are already in the buyer's frame of reference - the short list - are the ones that will most likely grab attention first.

Conversely, if you're not advertising or promoting, a large segment of the buying public may not even be aware of your destination and the prospect of them choosing it is a whole lot less likely. This may be a smaller or larger part of the buying public, depending on the destination but one thing is for sure. For this buying public, the only buyers who will choose your destination are the ones who already have a preference for it. People have short memories and are also easily distracted down the rabbit hole. So, even for past visitors, destinations are faced with a more difficult task in building this preference without some marketing in the form of of advertising. Billboards on the walls of the rabbit hole will certainly make a difference.

The success of certain destinations in attracting visitors is clear and the impact of advertising is a big component of this success. Consistent and ongoing advertising and promotion in feeder markets is needed to maintain name branding and awareness.

It also needs to be mentioned that after the first time visitor has had a successful trip to your destination, attracting the second visit becomes a whole lot easier. So, travel marketing to this cohort, while still needed, has a much easier task because the traveller's preference has now shifted in your favour. However, giving them away is a non-starter. Marketing to this traveller might include incentives such as bonus travel dollars to be spent during their next trip or a free tour, and so on.

Without continual marketing in the form of advertising, the risk of potential visitors being attracted by other destinations is just too high.

1. https://www.statista.com/statistics/814155/caribbean-total-contribution-travel-tourism-gdp-country/

2. GOVERNMENT OF JAMAICA, Ministry of Tourism, STRATEGIC BUSINESS PLAN 2020 - 2024, pg 53; https://www.mot.gov.jm/sites/default/files/public/mots_2020_2024-strategic_business_plan_revised_june_2020.pdf

3. https://www.statista.com/statistics/814155/caribbean-total-contribution-travel-tourism-gdp-country/

4. https://jamaica-gleaner.com/article/entertainment/20160111/sandals-skips-marley-us50m-pumped-global-dont-worry-campaign

5. https://jamaica-gleaner.com/article/business/20190920/reports-possible-sandals-sale-resurface

6. https://www.bangkokpost.com/business/2231355/tat-calls-for-more-tourism-stimulus

7. Here's How Much Travel Companies Spent on Advertising in 2021 by Donald Wood, TravelPulse, December 16, 2021; https://www.travelpulse.com/news/impacting-travel/heres-how-much-travel-companies-spent-on-advertising-in-2021.html

Note: Cuba is not included because access to data is very difficult but it is known tha Cuba spends quite a lot of money for advertising and also has a high number of annual visitors.